Internal Revenue Service P O Box 802501 Cincinnati, OH 45280-2501Ī foreign country, U.S. Box 802501 Cincinnati, OH 45280-2501Īlaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, South Dakota, Utah, Washington, Wyomingĭepartment of the Treasury Internal Revenue Service Ogden, UT 84201-0002

Internal Revenue Service Box 1214 Charlotte, NC 28201-1214 Youll owe interest on any payments made after the original due date. There arent any extensions allowing you to pay late. A valid extension means you can avoid a penalty for filing late. Box 1214 Charlotte, NC 28201-1214Īlabama, Georgia, North Carolina, South Carolina, Tennessee It's important to make sure your federal tax return is filed and received by the Internal Revenue Service by the filing deadline. If you cant file your income tax return by the due date, you can file your return up to six months late with a valid extension. Box 802501 Cincinnati, OH 45280-2501ĭepartment of the Treasury Internal Revenue Service Austin, TX 73301-0002 However, payments received after the respective due dates may be subject to penalties and interest.įor late 94X payments, please review IRS Publication 15 (Circular E), Employer's Tax Guide.Arkansas ,Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsinĭepartment of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 Yes, payments for Form 940, 941, 943, 944, 9 can be made until January 1, 2023, 7am Eastern Time. Please note that Installment Agreements must be arranged in advance with the IRS. You can make Installment Agreement payments for Form 940,940-PR, for Form 941, 941-PR and 941-SS,įor Form 943, 943-PR and for Form 945 for Tax Years 2002 through 2021. Can I make an Installment Agreement payment? Partner Pymnt for BBA Modification, BBA Exam Push Out (As Reported on F8985) Balance Due Payments. Form 1065, US Partnership Return of Income Tax Form, Current Tax Year, Prior Years, Section 965 - Transition Tax, Section 965 - Transferee Liability Tax,īBA AAR Imputed Underpayment Form, BBA AAR Push Out (As Reported on F8985), BBA Exam Imputed Underpayment, Advance BBA Exam Imputed Underpayment,.(In fact, some states condition the validity of the extension upon 100. Slightly more than half the states require that you pay 100 percent of the amount you owe on your original return. This rule applies at the state level as surely as it does at the federal level.

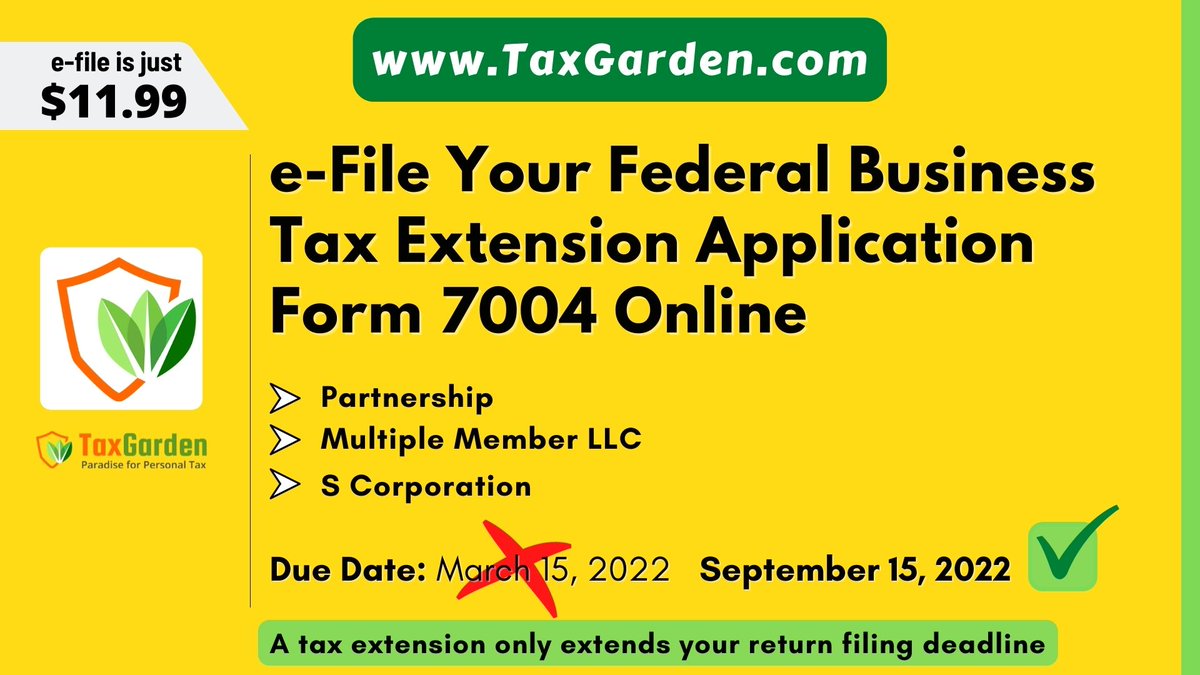

Section 965 - Transferee Liability Tax, BBA AAR Push Out (As Reported on F8985) Balance Due Payments, Partner Pymnt for BBA Modification,īBA Exam Push Out (As Reported on F8985), BBA AAR/Exam Push Out. An extension of time to file is not an extension of time to pay your tax bill.

0 kommentar(er)

0 kommentar(er)